Problem is most people here have never traded or don't understand it... They don't know about the money management factor in trading. Personally I don't think BM has done any trading based on how he designed this system.

Unless he learns something about the needs of traders and then agrees with it, I doubt we will see CNX work on an effective lending market solution.

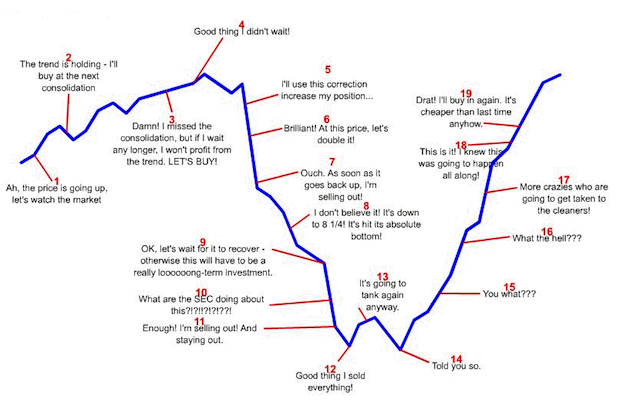

I mostly agree. Successful traders develop a different mindset and they know that money management is half the battle. To a successful trader, this is bad money management:

So you are not going to attract successful traders who are going to take that kind of risk... and you need successful traders to organically bootstrap liquidity. Otherwise, you will get no liquidity. Once liquidity is bootstrapped, then savers and investors can enter the picture and these markets can grow.

I believe the building blocks are in place... DPOS and a basic market engine. The basic design of smartcoins is sound, with a few tweeks necessary. However, many folks here don't quite seem to get it on a theoretical level. Bts provides many functions, one of which is collateral for smartcoins,

which makes the smartcoin creator a lender. The bts owner lends her bts to be used to create smartcoins. Now the question becomes, who does she lend the smartcoins to? The best case is for her to offer to lend them to other peers who can use those smartcoins to trade on leverage with other peers who have also borrowed smartcoins. Then the system works and liquidity grows organically attracting many other types of smartcoin users, but not until then. This is the only way in a derivatives market structured such as this. If she creates them and then sells them, then she is making a bad bet because of the risk/reward profile, unless of course if she charges a high enough premium, which is what we are seeing right now.

Once stealth is implemented, this should be our focus.