Do you mean it shouldnt be a separate software? I would like to know more about why it would be better.

The main reason is creating a DAC like (let's call it) Bitshares Lend would require a huge amount of resources. It would also split the community because the bitUSD from Bitshares would compete with the bitUSD from Bitshares Lend. So not only would their bitAssets compete but also they would compete for resources. At least that is one theory. Maybe it would be a good idea to keep them separate.

That is mainly where I come from. I am in Canada and there is no way for me to get into it.

To make it international, there could be an internal credit score rating. Dont know how that would work though.

Yea I would love to diversify my consumer debt across multiple countries. If one country gets hit harder than other countries I won't be effected as much. I don't think creating an internal credit score rating would be the biggest of our worries because most countries have a good way of determining credit worthiness and all of the methods are pretty similar.

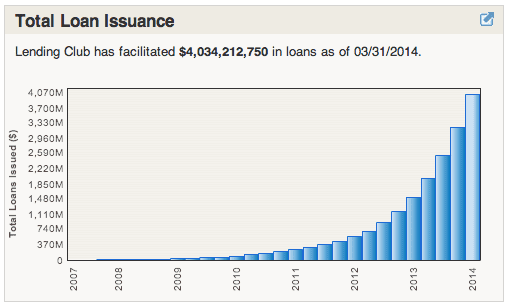

I think a bigger problem is that lending laws are different in every country (not only that but they can be different in different regions of the country). For example lending club is still trying to become legal in every state. There are p2p lending companies establishing themselves in many countries. The good news is we can walk in their foot steps.

I am not familiar with notes. I would love to learn more about that.

Sure, basically the way it works is you have an investor and a borrower. Let's say there is a borrower who wants $30,000. Once they get accepted by lending club their loan, credit score and other information (only info that is needed nothing that gives away their ID) gets publish so investors can see it. Investor have the opportunity to invest in increments of $25. Once the investor has given the borrower money he/she has created a note. So notes can be worth $25 or $3,500, whatever that particular investor gave them. I think the limit is 50% of the loan but I'm not sure, I've never tried.

Personally I only ever create $25 dollar notes but still invest $200 per person (so I create 8 $25 notes). The reason I do this is because notes can be sold and it's much easier to sell a $25 note than it is to sell a +$200 note.

Sorry if any of that confused you I'm not very good at explaining things.