Meet the honest.XAU smart coin. A derivative tracking the HONEST market value of 1 troy ounce of .999 percent fine Gold. All Backed by collateral held on the chain in a smart contract. Bitshares DeFi supercharges these smart coins essentially creating a Market Pegged Asset.

Phase 1: Be able to trade honest.XAU seamlessly between BTS, honest.BTC, and the stable coin honest.USD.

See the stats here:

https://blocksights.info/#/assets/HONEST.XAUHow to get it?Easy button: Trade for honest.XAU via the following liquidity pools- BTS / honest.XAU # 1.19.523

- honest.USD / honest.XAU # 1.19.525

- honest.BTC / honest.XAU # 1.19.524

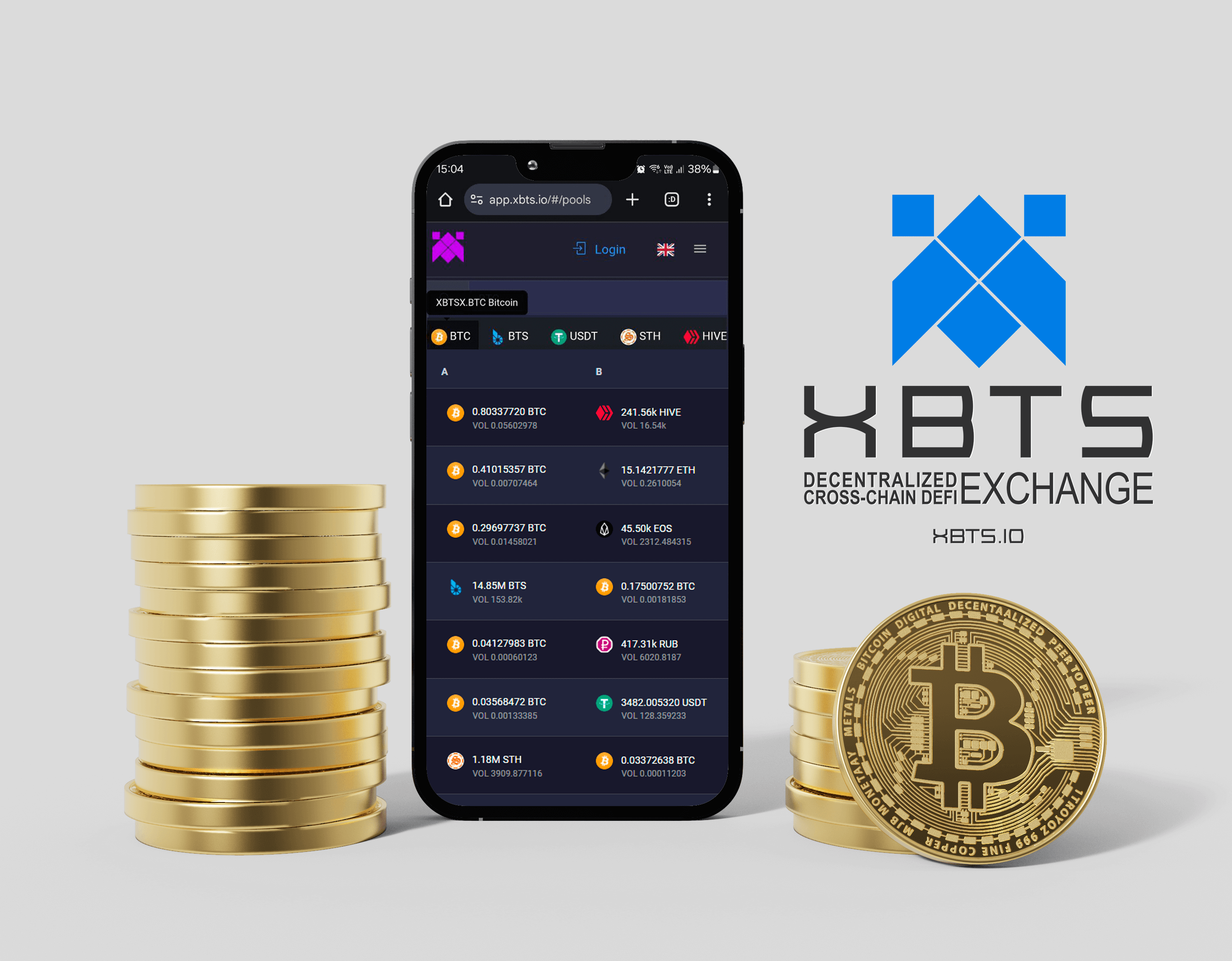

Name your price: Use the DeFi Dex

Name your price: Use the DeFi Dex Add to the ecosystem via borrowing & providing liquidity to the pools

Add to the ecosystem via borrowing & providing liquidity to the pools- Lockup your BTS as collateral to borrow honest.XAU for the best of both worlds. Go one step further and invest both BTS & honest.XAU in the liquidity pool to earn trading fee's!

Borrow:

Add Liquidity:

Where can it go from here?

Where can it go from here?- Phase 2: Seamlessly trade between native assets such as BTC.

- Phase 3: Real deal honest.MONEY. Created by being the gateway connection between all the smart coins such as honest.XAU, honest.BTC, honest.USD. Take a minute and study this map to fully understand the eco-system being created on the bitshares blockchain.

Recent Posts

Recent Posts