In the end it could be good for altcoins.

Of course it is.

Is Ethereum better than bitcoin?'

Of course it is.

Then who cares if they surpass bitcoin before we do. I hope they pass bitcoin tomorrow. I've been dying for the world to start talking about what is beyond bitcoin, and get nauseous whenever I hear the words "blocksize" or "coreXT" . We all knew that the Bitcoin topics of conversation would be changing to what it is that BTS does, so who cares if Ethereum gets the first mover advantage in the 2.0 space. The second and third movers will be right there in every news story!

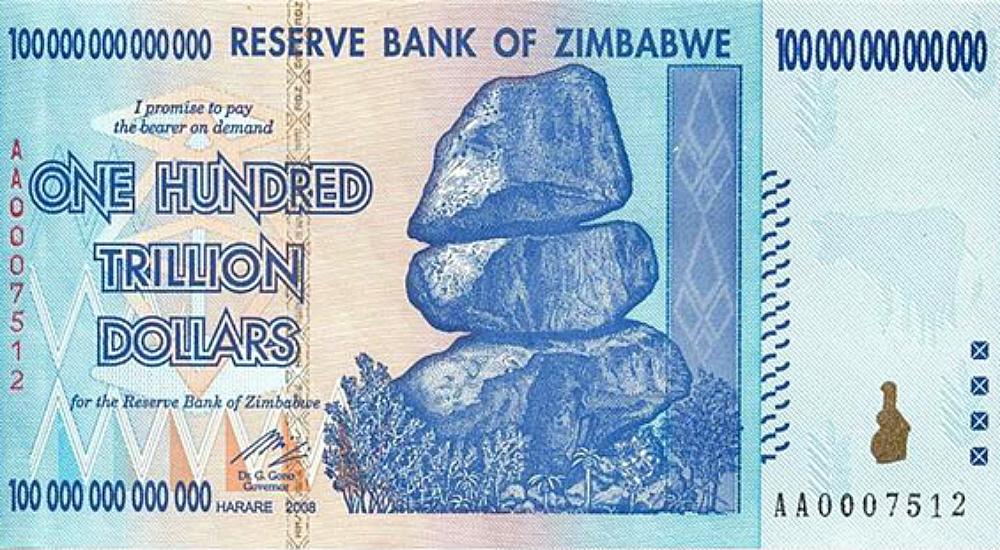

Right now Ethereum is only worth $100,000,000 fiat dollars (pocket change to some)

how much value is that?

We are talking about a global Bitcoin2.0 protocol standards here, where network adoption is paramount

what is that

worth (to humanity)?

It's not about how many Ethers or BrowniePoints you have, it's about evolving the global "Blockchain conversation" and Ethereum just taught the world a thing or two about Bitcoin 2.0