The ideal formula would yield an asset that retains constant purchasing power against an honest CPI.

Yes!

But we don't need to incur the risks of offering total "idealness" in a global economy where all major currencies are chronically inflating and can even be collapsed on purpose -- causing a hyperinflationary spike in any CPI referencing them. All we need to do is be  better than the best and we've got something attractive that a reliably appreciating BTS could provide to humanity.

better than the best and we've got something attractive that a reliably appreciating BTS could provide to humanity.

Where did you get this number,  ? What if inflation on all fiat from your basket will happen to be +8.79% during next decade? Than your token will lose purchasing power, although slower than fiat in your basket, but pity anyway

? What if inflation on all fiat from your basket will happen to be +8.79% during next decade? Than your token will lose purchasing power, although slower than fiat in your basket, but pity anyway

To be a successful currency, you don't need to outrun inflation. You just need to outrun the competition.

One of these could be my reason for picking 5%:I picked  because of its unique display characteristics in this forum - a hold-over from a distant pre-historic time which could live again.

because of its unique display characteristics in this forum - a hold-over from a distant pre-historic time which could live again.

When I got my first passbook savings account back in the 1960s that's what kind of interest was "normal" in a passbook savings account.

5% is enough better than what my mother can earn on her retirement accounts today to maybe get her attention (if she wasn't invested in BitShares instead).

5% is low enough that a steady rise in BTS of, say 10% annually, would start to be attractive to a hypothetical benevolent whale who might want to deploy a new currency with a hypothetical billion dollar annual revenue stream from some asset she owns. That stream could automagically issue the Dreamcoin which I postulate would be snapped up by The Greatest Generation and The Baby Boomers if they could earn 5% backed by real BTS collateral.

All of the above.

None of the above.As outlined in my original

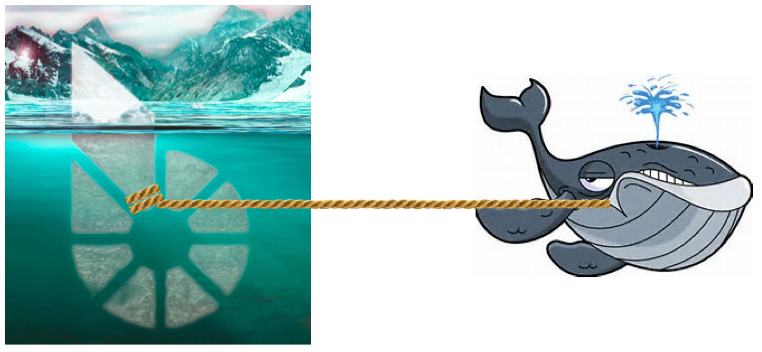

Whale Powered Assets article, I'm wondering if I could convince all the candidate benevolent whales out there that this would be a great thing to do with said hypothetical revenue stream because they could double their rate of return on that revenue stream by feeding it through the smartcoin issuing process thereby locking it up as leveraged collateral

that is appreciating due to the steady consumption of available supply of BitShares. And the older the smartcoins issued, the greater gain they would experience - which is the real incentive for said whale. Excess collateral from older coins could be harvested and fed back into the generation stream.

Viola! A fully back currency paying 5% is born. Surely there are marketeers who could sell something dirt simple like that. No other speculators need participate except the whale (although some might start participating once they see the plan working.)

Your actual mileage may vary, but I'm looking for the right parameters and any other insights from this community's thinkers. What breaks eventually? When we run out of great-grandmas?

One problem might be that the whale would eventually wind up owning >51% of the supply, turning BTS into a privately controlled network. The question is, would anybody care by that time?