Welcome to the ANTIBOUNTY Affiliate Program!https://smartholdem.io/antibountyBest Affiliate Program For 2020!

Starting out as a Antibounty affiliate you will get a referral bonus from each completed task. This means you get STH coins of completed blockchain tasks lifetime commission fees from the friends you invite and your friends get more STH coins from each completed task.

Joining Antibounty affiliates will give you the ability to generate a lifetime passive income for each person you directly send to Antibounty.

The Antibounty is a win-win for everyone. Once your referrals go to the Antibounty to earn crypto , you will earn crypto.

Antibounty lifetime commission offers you incentives on every tasks your referrals make in the future.

How does the Antibounty Blockchain Affiliate Program work?

How does the Antibounty Blockchain Affiliate Program work?

Antibounty is the only service in the world that provides you with activity from real crypto users with confirmation of orders & tasks on the blockchain! Explore Blockchain Twitter Tools!

Antibounty is a powerful tool for earning cryptocurrency for all participants:

Earn cryptocurrency for completing tasks.

Post tasks and get feedback from real crypto users.

Invite users to Antibounty and earn more STH on their every completed tasks on Twitter!

Grow your affiliate network!

GET STARTED https://smartholdem.io/antibounty

GET STARTED https://smartholdem.io/antibountyOpen the Online STH wallet on the platform website

https://smartholdem.ioRegister a wallet! Only YOU have access to your account!

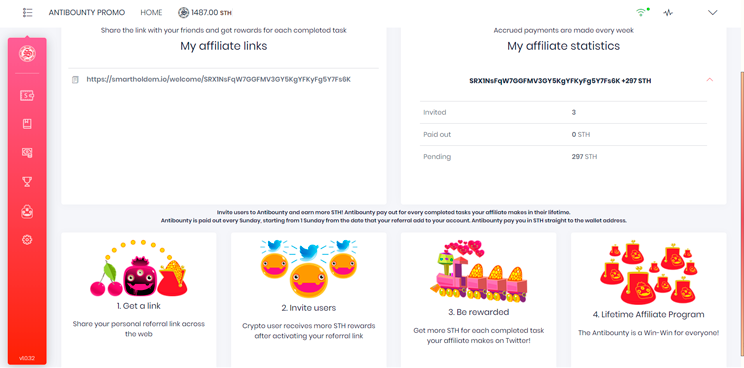

Open Affiliate in the section ANTIBOUNTY

1. Get your refferal link

1. Get your refferal linkShare your personal referral link across the web

2. Invite users

2. Invite usersInvite friends & give them programs for making extra money

Crypto user receives more STH rewards after activating referral link

The more users you bring to Antibounty, the more you earn

3. Be rewarded

3. Be rewardedGet more STH for each completed task affiliate makes on Twitter: Retweet, Like, Follow!

Get +1STH from each antibounty tasks transactions of your referred users!

4. Lifetime Affiliate Program

4. Lifetime Affiliate ProgramThe Antibounty is a Win-Win for everyone!

ANTIBOUNTY offers you 20% commission on all of your referrals earning crypto from antibounty website using your personal referral link, including lifetime future operations.

There is no limit to your commissions with the affiliate! ANTIBOUNTY pay out this commission for every completed task your affiliate makes in their lifetime. You can use STH Wallet to keep track of your referrals and transfer funds to the exchange at any time.

Antibounty is a Blockchain Twitter Tools platform, most users earn cryptocurrency for Retweet, Like, Follow on Twitter!

Antibounty is a Blockchain Twitter Tools platform, most users earn cryptocurrency for Retweet, Like, Follow on Twitter!Users are interested in getting your referral link:

ANTIBOUNTY gives affiliate users

STH commission on every tasks complited transactions. Commission from ANTIBOUNTY is for the lifetime of each referral.

!!! If the user does not have a referral link, he/she earns 4 STH for each action. After activating a referral link, reward increases and the user receives 5 STH for each completed task.

ANTIBOUNTY has many promotional tools available such as promo pics, referral links, and banners

ANTIBOUNTY has many promotional tools available such as promo pics, referral links, and banners -

https://community.smartholdem.io/topic/795/antibounty-affiliate-program/2

Invite users to Antibounty and earn more STH! Antibounty pay out for every completed tasks your affiliate makes in their lifetime.

Antibounty is paid out every Sunday, starting from 1 Sunday from the date that your referral add to your account.

Antibounty pay you in STH straight to the wallet address.

STH coin is a core asset of the XBTS DEX Exchange

https://xbts.io/.

You can exchange your STH coins for any popular cryptocurrency.

42+ Trading pairs. You can trade any amount, at any time, from anywhere, without withdrawal limits. No KYC.

STH has many options for use: for paying commissions for transactions on the XBTS exchange,

STH takes part in the SmartHOLDER Staking Program and in fair Blockchain Voting for XBTS Dex listing.

STH is a native coin for decentralized gaming platform SmartHoldem. STH use in DAPPs, DexGames and much more.

https://smartholdem.io/antibountyBecoming a Antibounty affiliate is a sure way to generate lifetime extra income. The more traffic you can generate, the more income you will make.

https://smartholdem.io/antibountyBecoming a Antibounty affiliate is a sure way to generate lifetime extra income. The more traffic you can generate, the more income you will make.