271

General Discussion / Re: BitShares Reform: Solving its Identity Crisis and Establishing a Brand.

« on: March 02, 2016, 10:20:42 pm »I don't know what exactly it is?

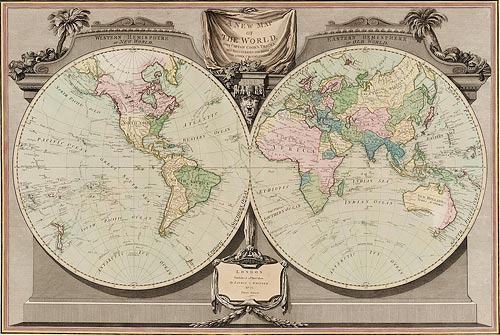

BitShares is a revolutionary new bank and exchange that could rival the value of the largest banks in the world such as JP Morgan and Bank of America in just a few years. How could this new upstart grow so quickly? BitShares offers a bank account that earns 5% interest where funds can be transferred inminutesseconds anywhere in the world with more privacy and security than a Swiss bank account. Your account can never be frozen, your funds cannot be seized, and the bank can never face collapse due to loan defaults or fraud. All of this is made possible without requiring any employees, lawyers, regulatory compliance, vaults, buildings, and other infrastructure required by traditional banks. Unlike existing banks, you can hold your balance denominated in gold, silver, oil, or other commodities in additional to national currencies while earning 5% interest.

In addition to acting as a bank, BitShares also serves as an exchange where currencies, commodities, and stock derivatives can be traded with most of the features used by professional traders including shorts and options.

If the largest banks can achieve deposits of over $1 trillion dollars with no meaningful interest, how many deposits could BitShares attract and what would that mean for the value of the bank?

That is some great stuff! If that first paragraph was a short advert we could send to friends, colleagues with a click-through at the end 'want to learn more' I think that would spread quickly!

While not a guaranteed

, even the interest is do-able & self funding, https://bitsharestalk.org/index.php/topic,21641.0.html

, even the interest is do-able & self funding, https://bitsharestalk.org/index.php/topic,21641.0.html