61

General Discussion / Re: UIA Giveaway - BRICS

« on: December 09, 2015, 01:26:33 am »

My account is bts: funny-bear

This section allows you to view all posts made by this member. Note that you can only see posts made in areas you currently have access to.

100k bts is the cost for implementing the feature.

It is NOT the votes needed to be approved.

#446 redistributes all trading fees from BTS to the referral program.

However, we have a new metric of referral (UIA creator). I think my preferred solution is to create a parameter that determines the percent of BTS market fees that go to the issuer of the asset it is traded against, and the remaining can go to the referral program.

This way future committee members can balance between UIA issuers and the referral program.

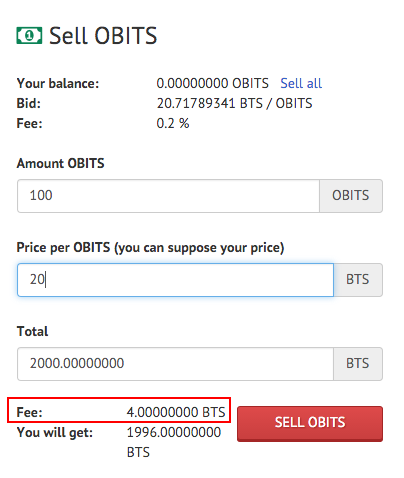

For every seller there is a buyer which means you get your fee.

You pay the fee upon receiving an asset. One side will pay 0.3% the other will pay 0.1%.

It isn't faulty. Imagine trading OPEN.BTC vs TRADE.BTC who should get the fees when those two assets trade?

If exchanges use exchange.bts/exchange.fiat pairs then should be no problem.However, it seems like the UIA issuer cannot collect market fee (in BTS!) from the trader who will be "receiving BTS" (a.k.a. UIA sellers) when a trade takes place. Why is that? Don't you think it's necessary for UIA issuer to be able to collect market fee from both the UIA buyer and seller, instead of the buyer only?

That would indeed be suboptimal. Can anyone confirm this is the design?

If this *is* the design, how can you expect existing exchanges to accept 50% less revenue when onboarding with bitshares?