301

General Discussion / Re: This one is worth paying for a transcript!

« on: December 07, 2014, 06:42:03 pm » Very good interview

Very good interview

This section allows you to view all posts made by this member. Note that you can only see posts made in areas you currently have access to.

Very good interview

Very good interview

IMO bitgold is one of the most powerful features bitshares has to offer. Huge demand exists for an actual decentralized gold-backed digital currency but this was never possible without third party risk. Bitshares does it best by using the global flow of information about price and on-chain collateral to maintain a peg. Bitgold may render the USD obsolete and, by proxie, bitusd obsolete. We may finally have a gold-backed digital currency that can't be altered by a central authority.

Looks to me that we need more delegates providing price feeds for Bitsilver and other bit assets....

http://www.bitsharesblocks.com/assets

Sent from my iPad using Tapatalk

The US National debt just crossed 18 Trillion.

The following debt chart is alarming.

http://upload.wikimedia.org/wikipedia/commons/e/ed/US_Public_Debt_Ceiling_1981-2010.png

The dollar may look strong, but it's being propped up by debt created through Quantitative Easing.

After the US went off their modified good standard in 1971, it took ten years for the national debt to reach 1 Trillion. Notice how fast it's grown since then.

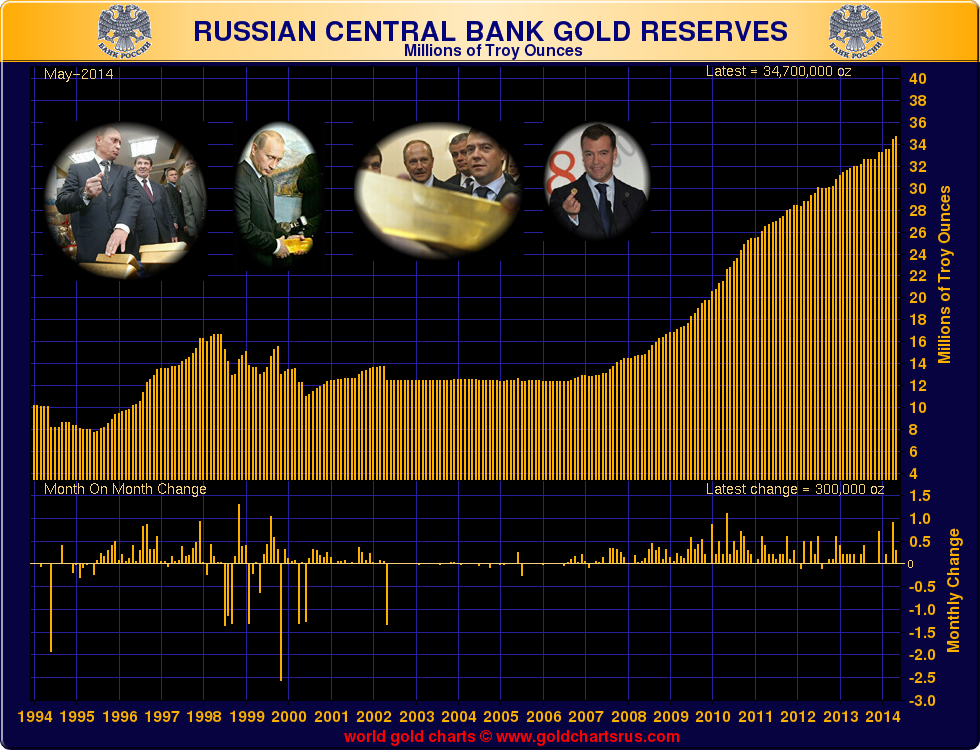

Why are countries wanting to repatriate their gold?

Likely because they know that the current system doesn't work and has to change.

Many believe that Gold will be the measure of accounting when the US dollar looses its reserve status, and the world must switch to a new monetary system.

BitGold maybe the best way to hedge against the coming hyperinflation that will occur when the current monetary system collapses.

Sent from my iPad using Tapatalk

I have some PTS now . but I don`t think it is a update of PTS, it is just a fork of bitshares. though III wanted to update PTS to DPOS, but it was old plan . III have airdrop BTS to PTS holder, and have announced that did not honour PTS chain. actually I think our community paid a price for this. in many Chinese investor‘s mind , PTS have dead.Bitshares PTS Mandatory upgrade? This is misleading at best and deliberately fraudulent at worst. This is a hard fork, created by a new developer. There's nothing mandatory about it. The idea that you even have the right to use the Bitshares PTS name reeks of an intent to deceive. I suggest you rethink how you're attempting this launch if you want to maintain credibility.

Upgrading PTS to DPOS has been planned for a long time, only nobody at I3 had the time to do it. Our project has the full backing of I3. This is about as official as we can get.

From a purely technical perspective of course we're starting a new chain with a genesis block based on a snapshot from the old chain. There's really no other way to do it. So from a purely technical perspective this is not a mandatory upgrade. You can stay on the PoW chain and see where it leads. Most likely it won't lead anywhere but simply stop in its tracks. And even if you manage to mine a few new blocks you may find it difficult to do anything with your mined coins Therefore, the upgrade is mandatory from an economical perspective.

they already sell PTS at low price. if someone bring PTS to live. I don`t know what it mean for our community?

All you said is correct, and we're investigating the possible cases where a conventional value analysis based on share of income from transaction fees could not possibly be sufficient to justify the demand you need to collateralize the assets being transacted.

Thanks to svk for getting the block explorer up and running (currently pointed to dry run#1): http://pts.bitsharesblocks.com/

Thanks. Looking good.

Thanks. Looking good. To confirm, the first 100 million SPK are allocated equally to BTS, AGS & PTS. Correct?

Yes

Off line trx signing infrastructure has been put in place.

Multi sig is what toast is working on right now.

Please don't forget to create a multisig transaction type where the transaction output can be spent like a normal multisig if there are enough signatures, but signature(s) from a subset of the keys (perhaps just one particular key) alone can only change the delegate slate that the BTS balance is voting for but not the multisig addresses of the original transaction. This way a user can update their votes with a hot client but to move their funds they would need to also sign the transaction with their cold storage keys. Bonus points if the same mechanism can also be used to claim yield on BitAssets without exposing all of the keys to move BitAssets to another owner.

In the pipeline: https://github.com/BitShares/bitshares/issues/981

Great. I think this will make a big difference to voter participation.

Great. I think this will make a big difference to voter participation.