1

Stakeholder Proposals / OIP1: Asset Feature - MLP2 (Market Liquidity Pool 2)

« on: June 21, 2020, 12:42:34 pm »

Liquidity is a big problem on the BitShares DEX, because there is no way to lend assets for market making.

Bancor and Uniswap got recently a protocol update. More users are using their service for lending and asset swaps.

The Onest Blockchain is a proof of concept for BitShares and BTS holder, to bring new innovations into the space. Which means an OIP can be freely exchanged for a BSIP and vice versa.

Abstract

What is new in MLP2?

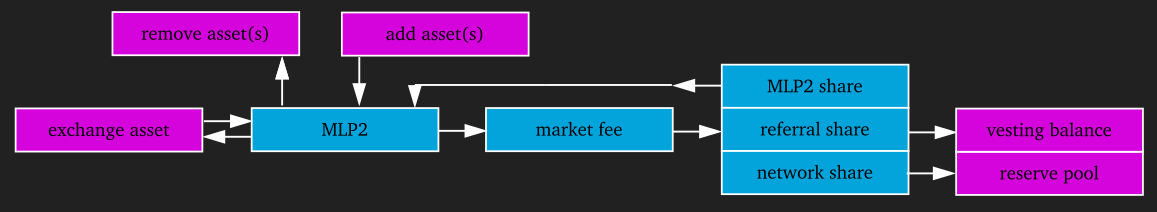

Flow Chart

Soruces:

https://github.com/Onest-io/OIPS/issues/2

https://bitsharestalk.org/index.php?topic=29651.0

https://github.com/bitshares/bsips/issues/213

Bancor and Uniswap got recently a protocol update. More users are using their service for lending and asset swaps.

The Onest Blockchain is a proof of concept for BitShares and BTS holder, to bring new innovations into the space. Which means an OIP can be freely exchanged for a BSIP and vice versa.

Abstract

- MLP2 is an asset lending feature, to provide liquidity for asset exchanges at the current price level

- Simplified version of the Bancor Protocol without connector weight

- Stepless liquidity with no order book for any asset pair

- Blockchain as borrower and liquidity provider

- ONS as central node and base currency

- Market fees are shared to asset lender and blockchain

What is new in MLP2?

- One asset deposit/withdraw to/from MLP2

- Non-core token liquidity pairs

- No orderbook integration

Flow Chart

Soruces:

https://github.com/Onest-io/OIPS/issues/2

https://bitsharestalk.org/index.php?topic=29651.0

https://github.com/bitshares/bsips/issues/213