16

General Discussion / Re: please adjust your price feeding algorithm to save bitCNY! (VERY IMPORTANT)

« on: February 06, 2018, 03:23:39 am »

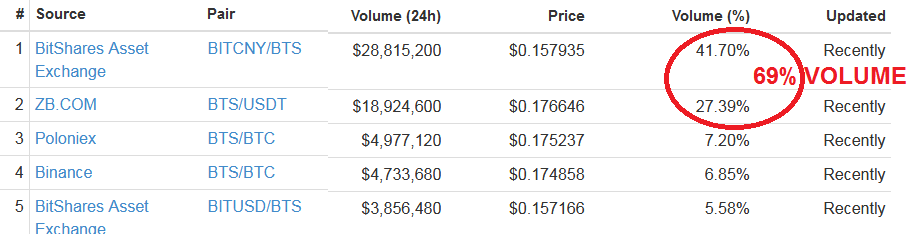

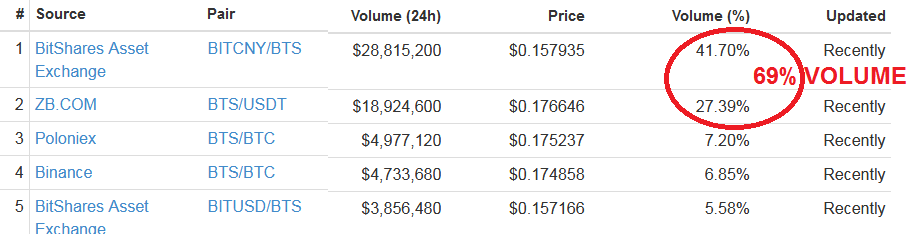

Coinmarketcap.com reports its price based on the highest volume markets, that includes centralized exchanges and certain coin pairings.

It appears that 69% of all Bitshares trading volume is happening with USDT and CNY, and as a result of that, the coinmarketcap.com price you see is based on that alone.

Look at this image for reference:

We need to discover what's happening with ZB.COM for USDT and with the recent problems with tether and USDT this could be causing Bitshares to freefall in price.

Please everyone speculate about this problem this and witness should re-consider their pricefeeds for ZB.COM and CNY in the short term.

Normally when you get those supposed "outages" at centralized exchanges, it is because they will allow deposits (but not withdrawals)... they use the excuse that they have a certain token under "maintenance"

The BTS DEX doesn't have this ability. It is up to our developers and witnesses to react when there is a problem.

I think we have a problem with USDT paired with BTS and then paired again with CNY which is causing the strange prices we've been seeing.

Let's get more eyes on this....

Is over-printed USDT being funneled through BTS causing this short situation?

https://news.bitcoin.com/bitfinex-printed-one-third-usdt-receiving-subpoena/

By the way, in the coming year I hope to become a bitshares witness. Please remember I brought this to your attention. I'm very careful about watching the health of our chain.

crypto4ever

(By the way, notice which thread and original OP I decided to post this to) --- only one user was concerned about ZB.COM and they've been quiet ever since November 2017.

It appears that 69% of all Bitshares trading volume is happening with USDT and CNY, and as a result of that, the coinmarketcap.com price you see is based on that alone.

Look at this image for reference:

We need to discover what's happening with ZB.COM for USDT and with the recent problems with tether and USDT this could be causing Bitshares to freefall in price.

Please everyone speculate about this problem this and witness should re-consider their pricefeeds for ZB.COM and CNY in the short term.

Normally when you get those supposed "outages" at centralized exchanges, it is because they will allow deposits (but not withdrawals)... they use the excuse that they have a certain token under "maintenance"

The BTS DEX doesn't have this ability. It is up to our developers and witnesses to react when there is a problem.

I think we have a problem with USDT paired with BTS and then paired again with CNY which is causing the strange prices we've been seeing.

Let's get more eyes on this....

Is over-printed USDT being funneled through BTS causing this short situation?

https://news.bitcoin.com/bitfinex-printed-one-third-usdt-receiving-subpoena/

By the way, in the coming year I hope to become a bitshares witness. Please remember I brought this to your attention. I'm very careful about watching the health of our chain.

crypto4ever

(By the way, notice which thread and original OP I decided to post this to) --- only one user was concerned about ZB.COM and they've been quiet ever since November 2017.