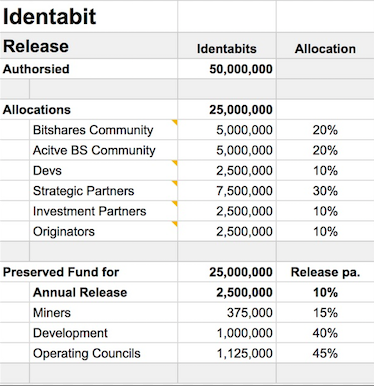

Identabit's 20% sharedrop on BTS is not so clear cut, as Ander and others have pointed out. It is 10% of total supply, 20% of the initial supply.

Shentist, you deserve some and will likely get some if you continue to re-post in this thread; it took me 4 posts over 7 weeks and several private messages - to finally get recognized, I feel your disenchantment with the whole thing.

Pretty clear cut. You start out at 20% and have time to decide to keep it or dump it while its still 20%. What happens in the long term does not affect the value proposition of the sharedrop.

Identabit will have no vesting?

Is there going to be any way to claim Identabit (it sounds as if any use of our wallet will first require KYC/AML identification) without tying it to our equivalent BTS holdings?

I'm surely no expert in this area, but this issue worries me a bit - is there a solution to this?

Excellent questions! I'm amazed no one has asked these before. We've been expecting them.

Yes, the original announcement mentions vesting - something deemed essential to starting a new coin since we see painfully what happens to a coin when too much supply is on the market all at once.

When a traditional company issues stock, it remains illiquid for many years before a new round of funding or public offering makes it liquid. As a result, those initial shares don't compete with the company's ability to sell additional shares to fund operations before it develops self-funding revenue streams.

Cryptos are too liquid. If you read The Most Excellent Summer Adventures of Tonyk, you'll find his strategy was essentially, "Hmmm, nothing is scheduled until late This Summer, let me take my money elsewhere for ten weeks and then bring it back closer to the next round of big news." Very good for Tonyk, I don't blame him for taking advantage of the rules. But for that reason, we can't continue to have such rules.

Full liquidity is deadly for a crypto because it sucks out the investment dollars when they are needed most and drives down the price for those who are trying to use those funds to do development. Investors aren't really investors if they don't leave their funds in company during the Long Hard Slog of development. They are speculators. And they only give the company their money during Big News days and then are gone again while the company struggles.

Enabling such behavior is called a Type One Error in emerging sharedropping theory.

So, vesting is here to stay. It essentially emulates how startups work and keeps the capital inside the startup until it succeeds.

"But wait!", says the shameless speculator in the back of the room, "If I can't sell right away, then technically you guys can dilute me before I get a chance to fecklessly dump and collect my full 20% of the sharedrop. You need to plus-up my sharedrop to offset whatever dilution is going to take place during the vesting period! I deserve to be able to take my money and invest in Ethereum while the developers must endure my selling pressure and are forced to sell theirs at deep discounts to buy groceries!"

Yes, there are people who think that way and expect sympathy from the developers.

Except that there will be NO dilution during the vesting period because John underwood invented Proof of Appreciation. This says that no new shares enter circulation until there is proof that the shares have appreciated enough to offset the dilution. So your 20% can never lose value due to dilution and you can sell it while your shares have appreciated to offset any new supply that may trickle in.

Thanks for that answer, Stan.

This is exactly what I was hoping for and glad that it will set a solid precedent for future sharedrops and community support.

Now, about KYC/AML. It is true that Identabit requires all accounts to have positive ID and you can't collect your sharedrop without an account.

Catch 22?

No. Remember the purpose of a sharedrop is to target people who will be your supporters, not to give away free money. If a person won't sign up with a verified account even to collect free money, then they are identifying themselves as people that Identabit wouldn't want to sharedrop on anyway.

Put it another way. The sharedrop is a way to get people motivated to overcome their natural crypto-reluctance to identify themselves, even though they do it every day to collect their paychecks and pay their taxes. Just because we want some place to keep our finances anonymous does not mean that every place has to be anonomyous. So, requiring us cryptoheads to register helps break down that barrier, and is thus a key strategy to get cryptoheads used to the concept of having a mix of anonymous and identity-based accounts. Knowing how to use both is a key to the complementary roles of BitShares and Identabit the way folks know the difference between savings and checking acounts today.

Those who are not willing to take that little leap, will never be Identabit supporters anyway and are thus self-judged to be likely dumpers.

Eliminating likely dumpers is a key skill in Sharedrop Engineering. It is not something that needs a solution.

I'm not concerned about KYC/AML with

Identabit .

I'm concerned that there may not be a way to claim our sharedrop without giving away the corresponding public address and quantity of our

Bitshares.

Maybe it doesn't work this way and there is something that I'm missing, but from my limited understanding, anyone who would have access (for any reason) to view my Identabit Genesis claims, would be able to link it back to my BTS holdings as well (by seeing what addressed moved what)?