AMM是需要运营的,今年三月开始的BTSDAO可以说是社区自发承担起了运营的职责。

GDEX这样的网关的需求与BTSDAO所做的事情有着天然的契合,于是后来GDEX也深度介入了BTSDAO。

初期的BTSDAO有不少比较初级的设计,比如,农历质数日空投就是一个很奇葩的设计,除了给撸羊毛者以可乘之机外并没有带来什么。

3月初到5月中,BTC价格从60000刀左右一路跌到30000出头,与之对应,DEFI由于规则不够合理,DEFI池深度尚浅,同时受市场大势影响,DEFI价格也一路从最高0.006U跌到最低0.00062U。

5月27日,第一次换届选举完成。

5月29日,GDEX提出冲浪计划。

5月31日,投票决定GDEX.EOS, GDEX.USDT加入冲浪计划。

6月10日,DEFI空投新规则通过,开始实施。

6月17日,投票通过GDEX.ETH加入冲浪计划。

7月6日,理事会在腾讯会议召开线上语音会议。

7月10日。投票通过GDEX.BTC加入冲浪计划。

8月3日,投票通过取消CNY/EUR和USD/EUR空投。

8月4日,与bts++达成合作,在bts++钱包中增加BTSDAO挖矿专区。

8月21日,通过DEFI空投减半计划。

这段时间,随着一系列的改进,新的资金的进入,以及市场整体回暖,DEFI价格也从底部一路上涨到0.0034U左右。

随着DEFI池深度不断向好,DEFI价格逐步稳定,但是,目前的机制中还有许多不足之处,需要加以研究和改进,BTS6.0上线可以给BTSDAO带来新的拓展空间,但是这一天的到来还需要时日,目前,DEFI的改进还需要立足于闪兑这一功能,即便仅从这一处着眼,需要改进的地方依然很多。

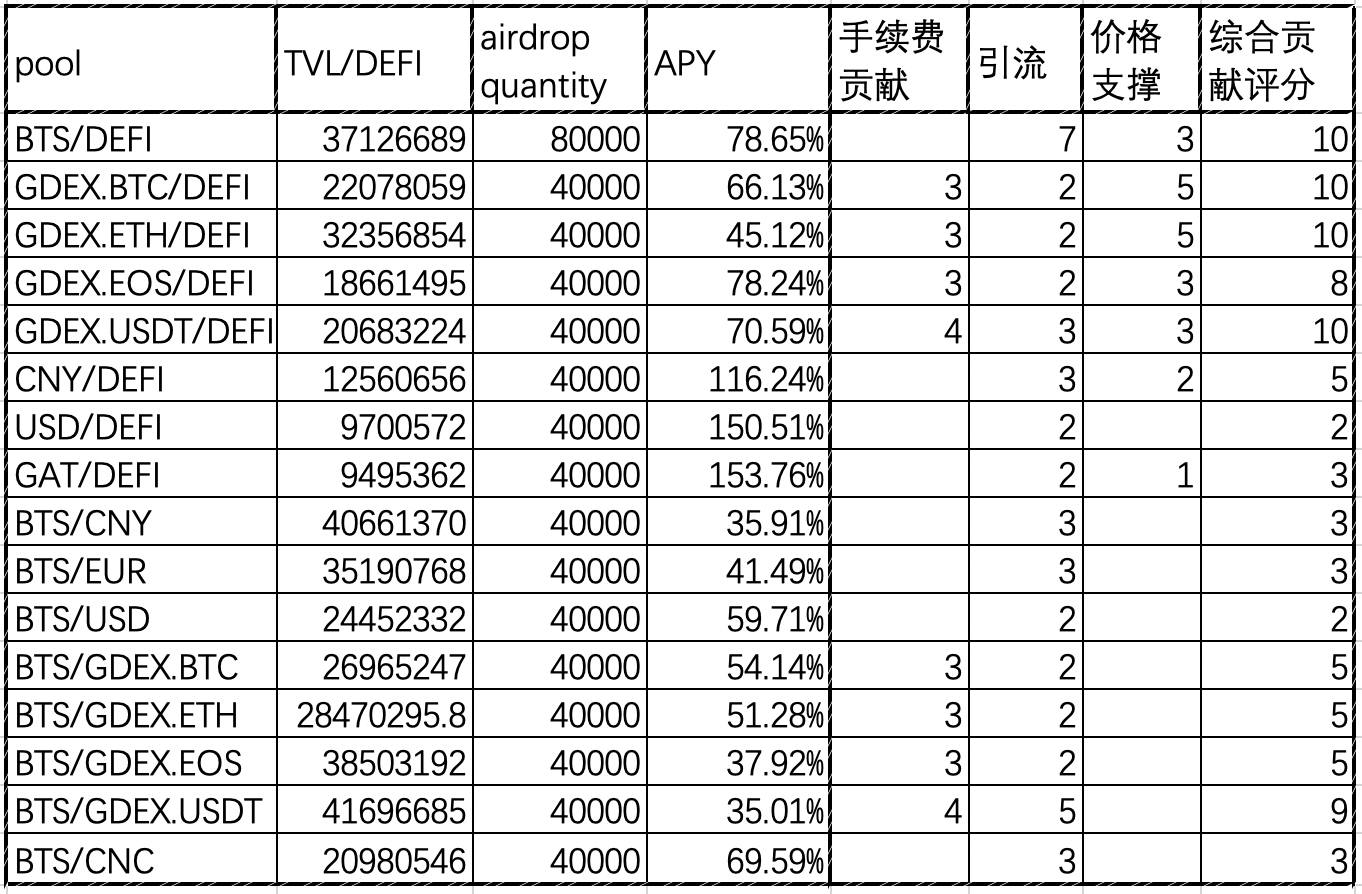

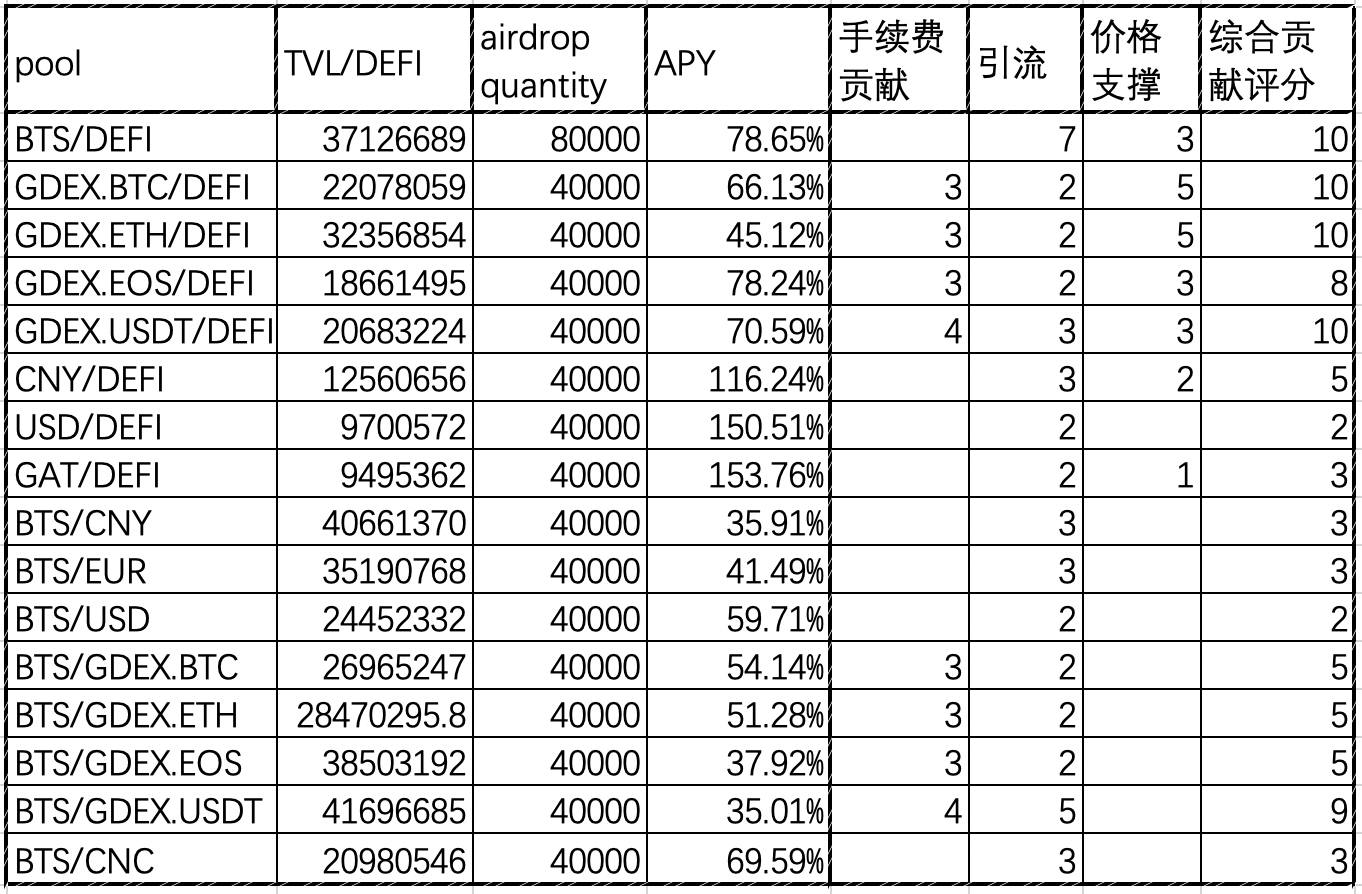

上图是对所有的空投池做了一个大致的评分,空投好比是给LP发工资,而LP提供做市服务,评分评的是LP提供的做市服务对生态的贡献。

问题一,哪些池子是贡献最大,或者说,有潜力贡献最大,以至需要加强的?我觉得有三个最值得关注的,就是BTS/DEFI. BTS/GDEX.USDT和GDEX.USDT/DEFI。

BTS/DEFI自不必说,两种原生币的池子,挖矿参与人数上也遥遥领先其他池子。

BTS/GDEX.USDT为何重要呢?

因为这是内外盘之间对冲套利最便捷,流动性最好的池子,是体现DEFIswap交易价值的第一池。

币安,火币等头部交易所不仅有BTS现货交易,也有BTSUSDT永续合约,通过BTS/GDEX.USDT池和这些头部CEX之间对冲套利方便,成本低,目前BTS/GDEX.USDT池的TVL为280万BTS左右,做市年化已经连续数日保持在6%以上,如果能够进一步强化这个池子,比如让TVL达到1000万BTS,可望吸引更多的BTS交易者的注意,更好地自我造血。

目前DEFI池可分为两组,一组只有GDEX.USDT/DEFI,另一组包括所有其他DEFI池,随着市场波动,DEFI在两组池子间流动,当市场向好,BTC,ETH,EOS,BTS等币种价格上扬,DEFI从GDEX.USDT/DEFI池流出,流入其他池,当市场下行时,各大币种价格下跌,BTC,ETH,EOS,BTS等币种价格下跌,DEFI从其他池流出,流入GDEX.USDT/DEFI池,此时,GDEX.USDT/DEFI池起到支撑DEFI价格的作用。但现在的问题是,GDEX.USDT/DEFI深度不够,面对其他几个池子的DEFI流动性,承接时常常显得力不从心。

我建议,把BTS/GDEX.USDT池和GDEX.USDT/DEFI池提升为一类池,三个一类池形成铁三角,各自发挥特定的定海神针作用。

同时,把一类池的TVL门槛提升到200万BTS。

问题二,如何看待bitAssets相关池?我认为,目前bitAssets已是鸡肋,在曾经的战略机遇期没有做大做强,而现在,这个战略机遇期已经过去了。

现在复盘的话,我觉得最大的问题是,bitAssets设计中一直没有加上收取利息的功能,这使得bitAssets为整个系统的造血一直极为有限,从而无从反哺促进各项性能的提高。

目前bitAssets一方面限额,一方面提高抵押率,结果是生态逐渐凉凉,当用户需要付出三倍的抵押率还不一定有额度借款时,用户的借款意愿是很难保持的。

而且也没看见这样的限制措施真的降低了风险,bitUSD依然全局清算,bitCNY依然动辄黄单压盘。

如果用户想利用手中的BTS借款又不想卖掉BTS时,大可以到币安卖掉BTS再去开一个永续合约的多单,真没必要来跟三倍抵押和没有额度怄气。

供应量缺失的结果是溢价严重,稳定性受损,而且,现在观察到的是,BTS价格上扬时bitAssets溢价甚至常常更加严重,因为抵押借款的增加跟不上BTS价格。。。

我的建议是,BTSDAO没必要对bitAssets投入过多资源,因为这些池子一来也不贡献可以回购DEFI的交易费,与外盘也没什么连接,起不到引流的作用。这些bitAssets本身的交易价值也极为有限。

即便BTS/CNY, CNY/DEFI,BTS/EUR这样的池子暂时可以保留的话,BTS/USD和USD/DEFI这两个池子也应该坚决地取消空投。因为除了和其他bitAssets池一样评分低之外,USD还长期处于全局清算状态。

可以这么说,给全局清算状态的资产池空投DEFI给BTSDAO打上了不负责任的标签,难以洗白。

问题三,AEX相关池意义大么?从本身讲交易价值一般。

AEX自己都下架BTS/CNC了。

GAT价格也不坚挺。

当然,如果能够借这两个池让DEFI上AEX,那还是很有意义的。

BTSDAO最终走向何方,是走向1DEFI1BTS还是平庸地苟且,根本上还是取决于项目团队的能力和格局,最初的规则有不足之处,留下一些历史包袱,需要不断克服阻力不断进步,才能未来可期。