The Lifetime Membership (LTM) is not very attractive at the moment, compared with other platforms.

Openledger already did a great job by providing a registrar with 0% and gives the full 80% to the referrer.

The problem is that LTM is excluded from a big chunk of fees (Gateways/Market Maker).

To solve this problem three things should be changed:

- Taker fee should increase 10x compared to maker fee, because this can be count as a transaction, except the margin call side

https://bitsharestalk.org/index.php?topic=27164.msg322698#msg322698- Gateways should fully implement a 40% cut on all fees to LTM, thanks to OpenLedger

https://github.com/bitshares/bsips/issues/102- The market maker fee of 0.1% for USD/CNY should be split:

-- 0.05% goes to the trader

-- 0.01% goes to a community-workers budget to finance projects like

https://steemit.com/bitshares/@bangzi/bitshares-community-100-cities-100-stores -- 0.04% is used to buy back BTS and share drop on LTM

The people with an LTM are the most important people on the BTS platform and are essential for:

- creating content about BTS

- getting new users

- helping new users

- reporting bugs

- integrating new projects

- providing liquidity

- increasing volume

Without a fully integration of the fees to the LTM, there is no substantial demand for an LTM, grow in user base and adoption.

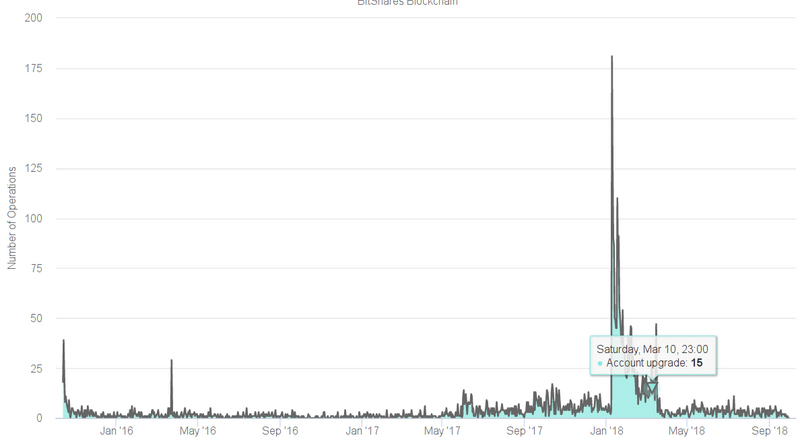

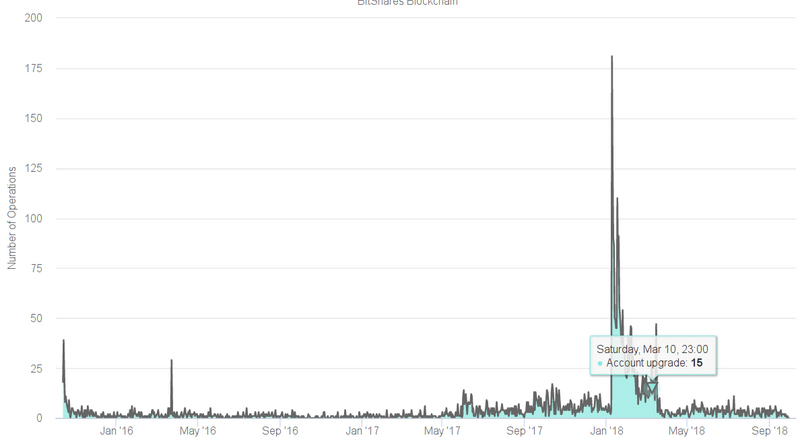

The chart of account upgrades shows the full dilemma: