The honest.asset eco system attempts to answer the age of question of how to create, distribute, and utilize sound money.

Let's face it, most blockchains such as bitcoin will never be used for day to day small transactions. This issue does not make bitcoin worthless, so why not utilize the value of bitcoin to provide the backing and collateral for an asset that can be sent worldwide, in under 3 seconds for a miniscule fee?

Why not have a native blockchain based stable coin backed by collateral everyone can see/audit?

Currently assets plugged into the honest.asset ecosystem are created by a user locking up AT LEAST 1.4x collateral, denominated in bitshares, to "borrow" the honest.asset. Here is one example how that looks: A user wants to borrow 10 honest.USD by putting up 3x the collateral of 21,000 bitshares.

With the honest.USD now borrowed by the user, they could send it anywhere in the world in under 3 seconds at a miniscule fee! An investor on the other hand, might place that honest.USD & bitshares into a liquidity pool to earn fee's from other users exchanges those assets.

Take this to the next step and by studying the map of honest.assets, you can see how all these assets & liquidity pools are tied together into honest.MONEY. Users and automated trading software continually balance out the prices of the assets by being able to move through honest.MONEY into any and all of the assets in the ecosystem.

Therefore, honest.MONEY becomes blockchain based sound money that is backed by the collateral users/investors placed to create the entire ecosystem in the first place.

What does the future hold?

Additional liquidity for each asset in the ecosystem.

Additional assets added to the ecosystem

Additional IN/OUT gateway's to exchange the native asset directly for an honest.asset. IE BTC > honest.BTC instead of BTC > gateway.BTC > honest.BTC. This reduces the users risk of being stuck with a non blockchain backed token. Gateways will eventually accept honest.BTC > BTC exchanges because honest.BTC holds value where as gateway.BTC is tied to a specific gateway, think Mt. Gox.BTC.

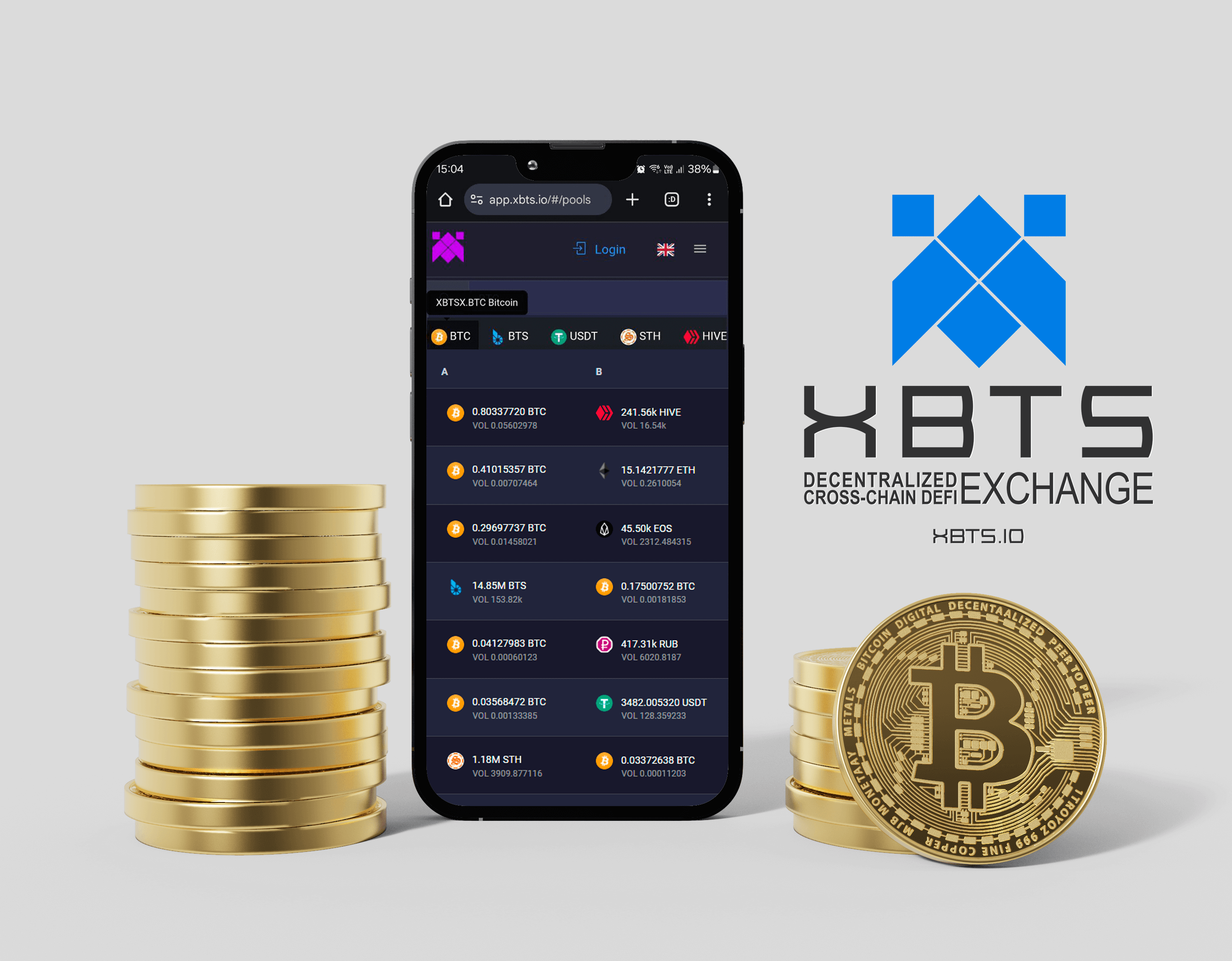

You can explore this ecosystem now by utilizing any of the bitshares wallets:

Decentralized Web Hosted DEX wallets (Make BACKUPS!)

Android Mobile wallet

Power Users and Traders use Astro UI (need both parts to work)

Recent Posts

Recent Posts