16

General Discussion / Re: BTSDAO, A Liquidity Mining Project

« on: August 07, 2021, 05:02:39 am »

This section allows you to view all posts made by this member. Note that you can only see posts made in areas you currently have access to.

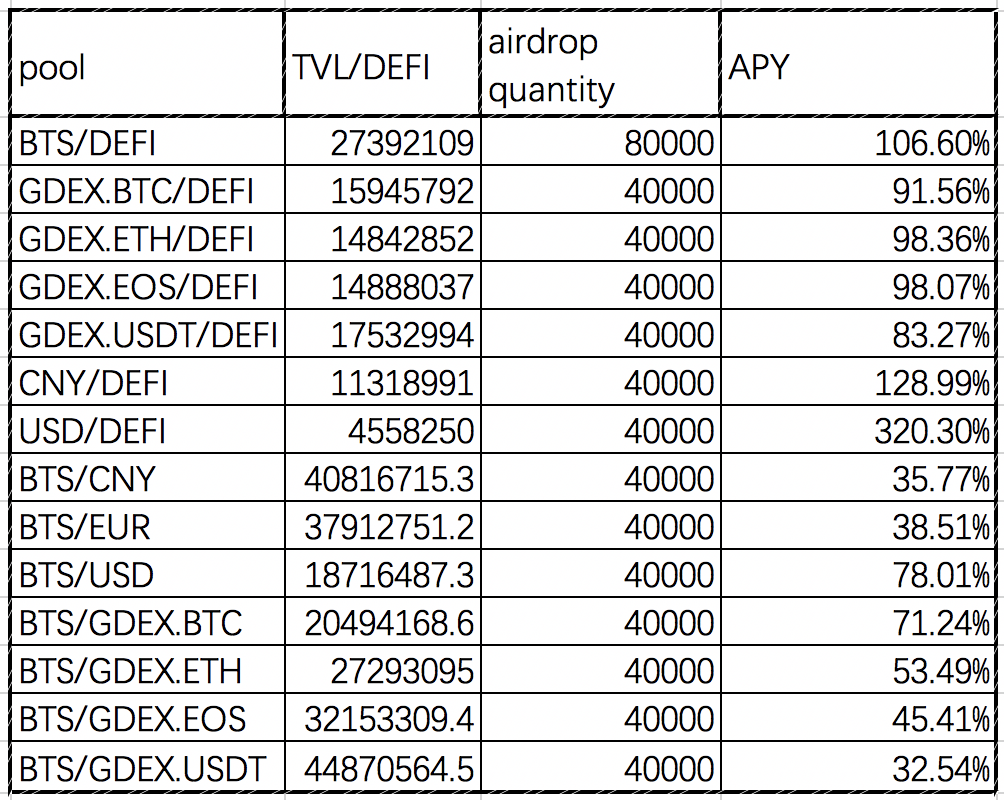

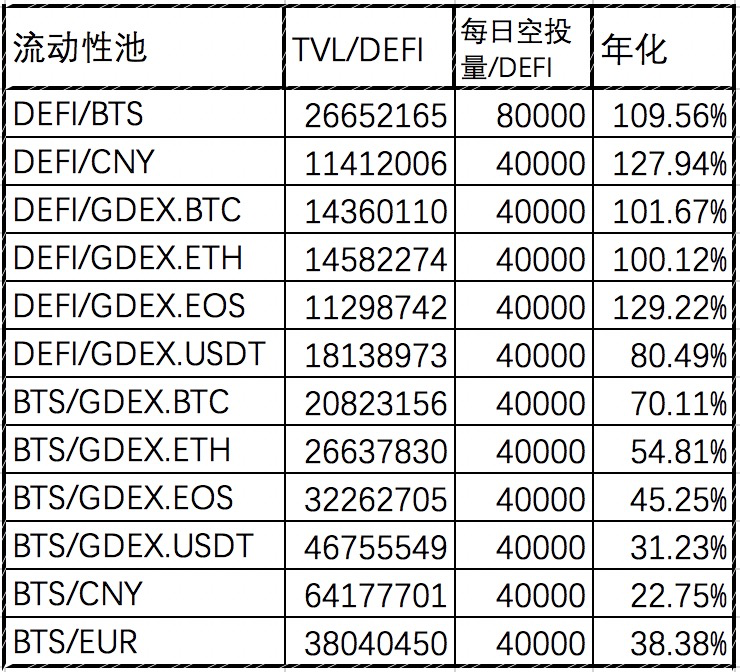

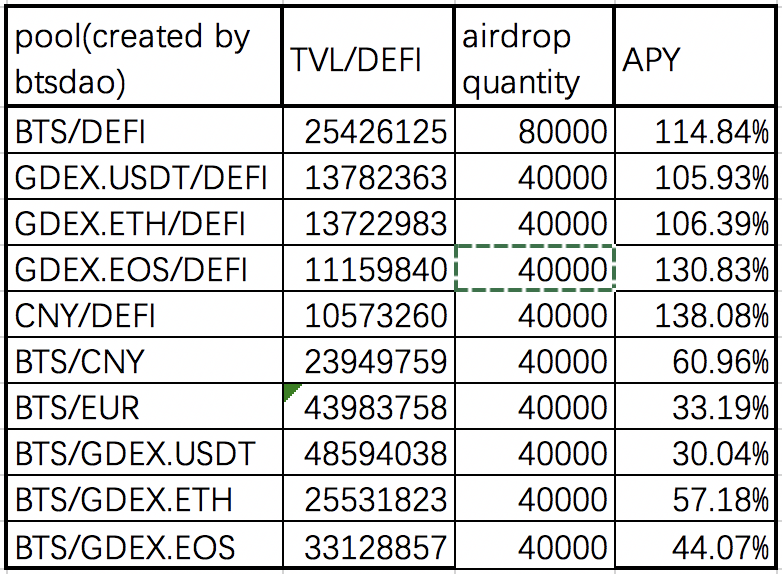

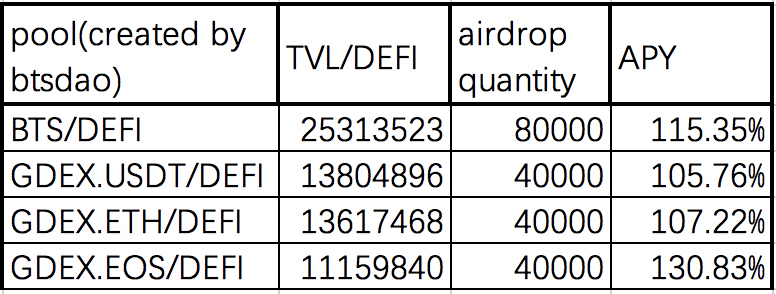

today's APY.

Can you please share the exact formula for your APY? I do get very different results atm

图挂了是的,目前翻墙可以用,正在积极想办法。

应该是获取充提地址的 API 地址被墙了。

I've added new metrics

https://blocksights.info/#/pools

Right now the calculations are based in BTS (the yield is w.r.t. to BTS value increase/decrease), switching to something stable might make sense since not everyone is a BTS maximalist

I feel BTS is OK, the key point is that all the pairs are in the same base, but now it seems the volumes are on different base, all on asset B?

Everything is converted to BTS value using latest market price before calculations. Please let me know if you see strange numbers, and if do, which ones they are.