676

中文 (Chinese) / Re: 做市/交易大赛第三阶段

« on: December 23, 2019, 02:58:50 am »

我建议理事会重新考虑交易大赛的规则,以更好的达到交易大赛的目的。

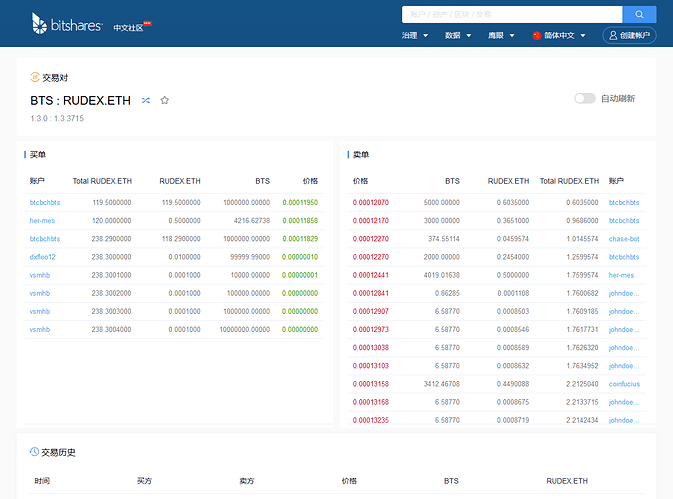

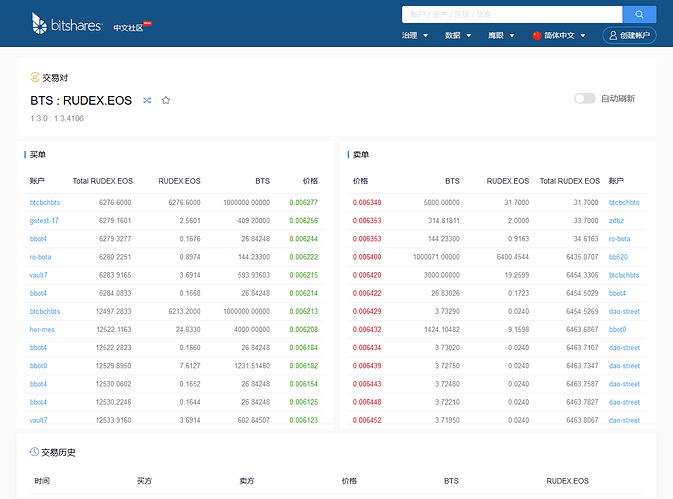

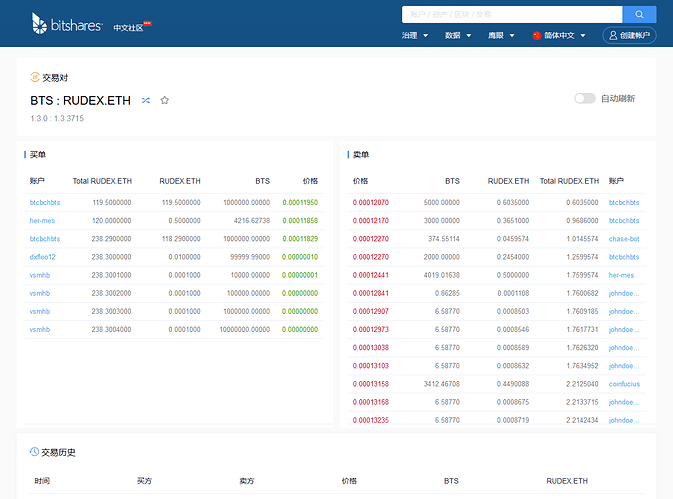

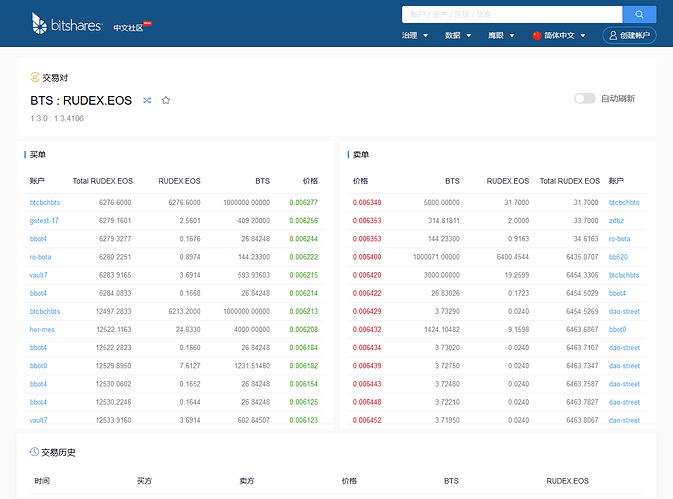

每个网关交易对的日成交量必须作为硬性衡量标准,不然现在ETH、EOS区直接就是薅羊毛状态,这些交易对基本属于无人区。

ETH/EOS与BTS的用户交叉状态太少,ETH有MAKERDAI做抵押杠杆,EOS也有相应的抵押杠杆,BTS作为定价资产根本无法吸引这部分用户,并且内盘用户基本对BTS/ETH,BTS/EOS这些交易对没有多少兴趣,不仅价格换算麻烦,而且外盘也没有有深度的交易对提供价格参考,即使提供奖励也难以吸引流量过去,基本都是薅羊毛的流量。

而且系统无法从这些交易对获得任何手续费的收入。

从17号到23号,基本快一周的时间,如果真的能够吸引人,这些交易对的交易量也基本能够达到,多的不说至少应该能够达到BTC或者usdt交易对的一半水平,而事实并非如此,我们每日在这些交易对发放的奖励基本都快是这些交易对日交易量的一半多了,这有多大的意义?!

--------------------------------------------

以日平均成交量做为基础衡量标准:

1. 可以防止死亡交易对被人薅羊毛的情况,想要薅羊毛的资金自己去把交易量维持起来;

2. 可以促进交易活跃度,避免现在躺着吃糖或者被动挨刀子的情况,想要定价权,活跃度必须大于外盘才行;

3. 可以节约大赛资金,防止低绩效,资金是系统出的,也要有考核,防止被过度薅羊毛,一分钱有一分钱的用处。

-----------------------------

日均成交量 = 抓取日内4小时成交量六次,取中值;

比如日均成交量基准为0.5M bts(3M bts日成交量也就火币的水平,以现在是价格计:30万人民币左右).

成交量统计:maker成交量与1000bts以上成交量(能统计最好,无法统计也无所谓)

奖励=基础奖励+成交量奖励

#基础奖励池各个交易对平均分配;

#成交量奖励池为总成交量奖励池。

#总日均成交量=各交易对日均成交量之和。

if

单交易对日均成交量 < 基准成交量,

基础奖励的拨付=基础奖励池*(日均成交量/基准成交量),不进行成交量奖励分配。

if

单交易对日均成交量 >= 基准成交量,

基础奖励池全额拨付。

if

单交易对日均成交量 >= 基准成交量,且此交易对基础奖励全部分配完毕,则进行成交量奖励分配计算,否则不进行成交量奖励分配:

单交易对成交量奖励 = 成交量奖励池*(交易对日均成交量/总日均成交量)*(1- 基准成交量/日均成交量).

#基础奖励分配: 挂单者/量提供者=98/2?或者只提供给挂单者。

#成交量奖励分配;挂单者/量提供者=90:10?

#挂单者奖励分配按照原挂单奖励规则。

-------------------------------------

成交量考核基准各个交易对为一样的水平。

当然会存在疯狂机器人刷了天量,但是却没有几个挂单量,而计算出的成交量奖励分配比却很高,因此为了预防这种情况,建议检测这个交易对基础奖励量的分配情况,如果基础奖励量未全部分配,成交量奖励不拨付,基础奖励量分配情况在大赛原始规则里。

没有量谁也别想躺尸拿奖励,要么有人出来提供成交量,想要薅更更多的羊毛,就动起来。

说白了,就是鼓励刷量,没有量的交易所在整个市场中基本没有什么地位,也吸引不了几个用户,而且DEX即使刷也是真实数据,而不是假数据。

--------------------------------

除了薅羊毛的,普通交易者谁会挨个交易对的乱窜找配对,还不够各种转账手续费的。

每个网关交易对的日成交量必须作为硬性衡量标准,不然现在ETH、EOS区直接就是薅羊毛状态,这些交易对基本属于无人区。

ETH/EOS与BTS的用户交叉状态太少,ETH有MAKERDAI做抵押杠杆,EOS也有相应的抵押杠杆,BTS作为定价资产根本无法吸引这部分用户,并且内盘用户基本对BTS/ETH,BTS/EOS这些交易对没有多少兴趣,不仅价格换算麻烦,而且外盘也没有有深度的交易对提供价格参考,即使提供奖励也难以吸引流量过去,基本都是薅羊毛的流量。

而且系统无法从这些交易对获得任何手续费的收入。

从17号到23号,基本快一周的时间,如果真的能够吸引人,这些交易对的交易量也基本能够达到,多的不说至少应该能够达到BTC或者usdt交易对的一半水平,而事实并非如此,我们每日在这些交易对发放的奖励基本都快是这些交易对日交易量的一半多了,这有多大的意义?!

--------------------------------------------

以日平均成交量做为基础衡量标准:

1. 可以防止死亡交易对被人薅羊毛的情况,想要薅羊毛的资金自己去把交易量维持起来;

2. 可以促进交易活跃度,避免现在躺着吃糖或者被动挨刀子的情况,想要定价权,活跃度必须大于外盘才行;

3. 可以节约大赛资金,防止低绩效,资金是系统出的,也要有考核,防止被过度薅羊毛,一分钱有一分钱的用处。

-----------------------------

日均成交量 = 抓取日内4小时成交量六次,取中值;

比如日均成交量基准为0.5M bts(3M bts日成交量也就火币的水平,以现在是价格计:30万人民币左右).

成交量统计:maker成交量与1000bts以上成交量(能统计最好,无法统计也无所谓)

奖励=基础奖励+成交量奖励

#基础奖励池各个交易对平均分配;

#成交量奖励池为总成交量奖励池。

#总日均成交量=各交易对日均成交量之和。

if

单交易对日均成交量 < 基准成交量,

基础奖励的拨付=基础奖励池*(日均成交量/基准成交量),不进行成交量奖励分配。

if

单交易对日均成交量 >= 基准成交量,

基础奖励池全额拨付。

if

单交易对日均成交量 >= 基准成交量,且此交易对基础奖励全部分配完毕,则进行成交量奖励分配计算,否则不进行成交量奖励分配:

单交易对成交量奖励 = 成交量奖励池*(交易对日均成交量/总日均成交量)*(1- 基准成交量/日均成交量).

#基础奖励分配: 挂单者/量提供者=98/2?或者只提供给挂单者。

#成交量奖励分配;挂单者/量提供者=90:10?

#挂单者奖励分配按照原挂单奖励规则。

-------------------------------------

成交量考核基准各个交易对为一样的水平。

当然会存在疯狂机器人刷了天量,但是却没有几个挂单量,而计算出的成交量奖励分配比却很高,因此为了预防这种情况,建议检测这个交易对基础奖励量的分配情况,如果基础奖励量未全部分配,成交量奖励不拨付,基础奖励量分配情况在大赛原始规则里。

没有量谁也别想躺尸拿奖励,要么有人出来提供成交量,想要薅更更多的羊毛,就动起来。

说白了,就是鼓励刷量,没有量的交易所在整个市场中基本没有什么地位,也吸引不了几个用户,而且DEX即使刷也是真实数据,而不是假数据。

--------------------------------

除了薅羊毛的,普通交易者谁会挨个交易对的乱窜找配对,还不够各种转账手续费的。